A Yield curve helps us know to understand the state of the bond market better. The curve basically shows us interest rates or yields on different maturity bonds. Just by looking at the shape of the yield curve, we can get an idea about interest rate moves in the future.

In general, we hold bonds till maturity. And, the bond yield is the return we get each year till the time of maturity as per the specified conditions.

How do we get a yield curve?

It has mainly two components:

- Bond yields and,

- Time to maturity.

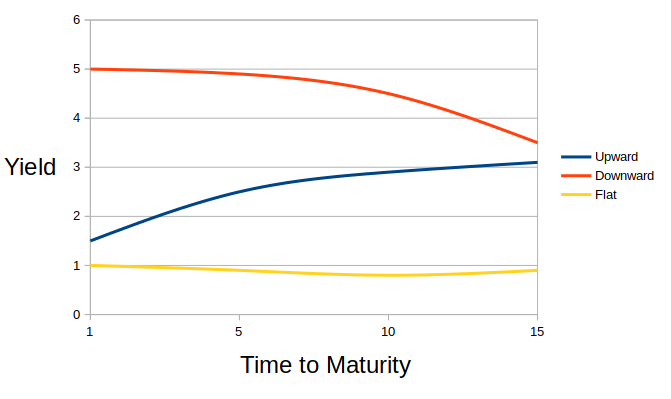

A yield curve graph shows us how bond yields vary across bonds that have differing maturities. And, the three yield curve shapes are:

- Upward sloping curve,

- Inverted curve and,

- Flat curve.

As already covered the shape of the yield curve depends on how interest rates move in the future. The x-axis shows the time to maturity while the y-axis is about annualized yields.

From the graph, we can see yields are lower for short-term maturity bonds. And, as time to maturity increases they get higher. On the other hand, they are higher for short-term maturity bonds but get lower when the time to maturity increases.

A flat curve occurs when yield stays stable irrespective of changes in time to maturity.

How it can benefit a regular investor?

Yield curves help us understand the state of the economy better. It reflects the market expectations. For instance, if the economic activity is expected to decline then it will result in a downward sloping curve. On the other hand, if the economy does well then we see an upward-sloping curve.

Apart from that, it provides an expected path of how interest rates will shape in the future. And, that can act as a guide to those who wish to borrow in the coming months/years.

It is worth mentioning here that, the yield curve is merely an expectation of the market. Things could turn out differently in the future.

Important: This material is provided only for information purposes only. It doesn’t constitute investment advice. We shouldn’t be held liable for the investment decisions readers take. We encourage readers to act at their discretion.